The Online Guide to the Namibian Economy

The Online Guide to the

Namibian Economy

Powered by

The Online Guide to the

Namibian Economy

Powered by

Agriculture

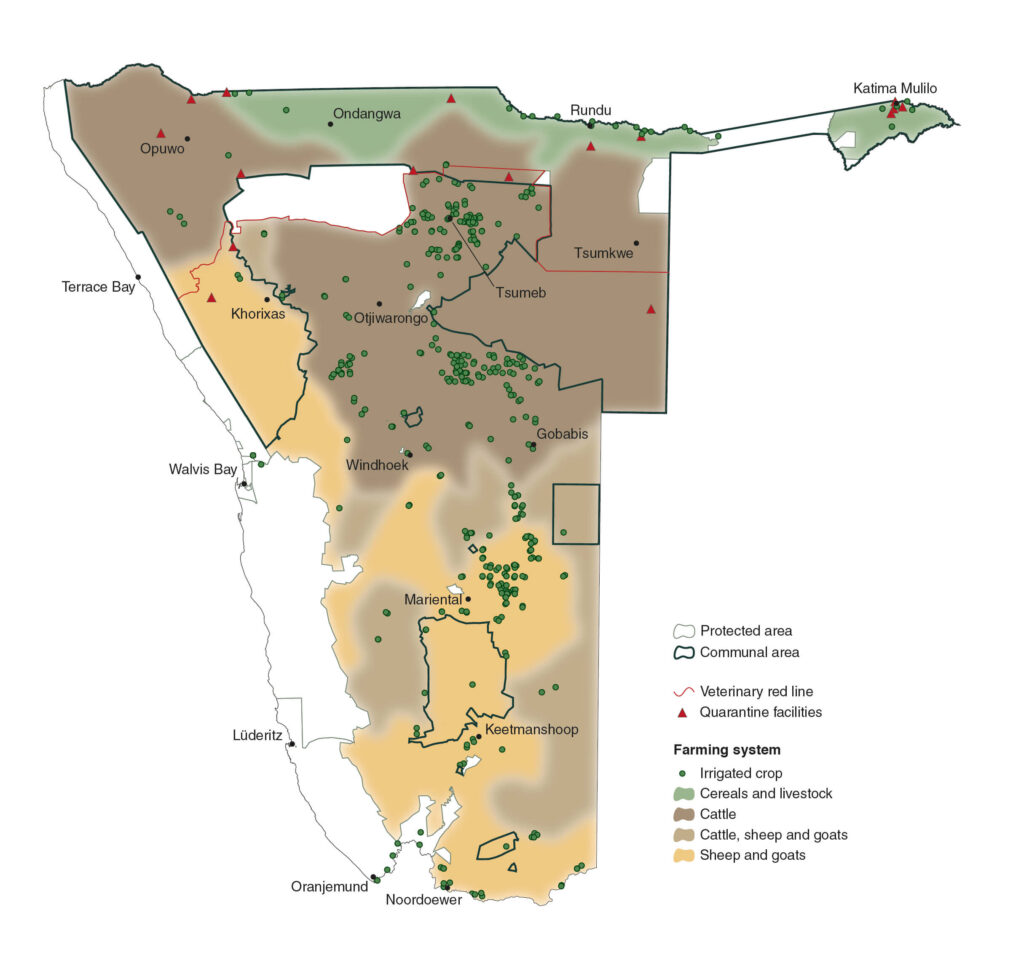

Namibia is the most arid country south of the Sahara Desert with low average and highly variable rainfall. Drought is always a possibility and the lack of water is an ever-present constraint in most parts of the country. This climate means that the potential for arable agriculture is generally limited to the north of the country where water is less scarce. In the central regions agricultural potential is confined mainly to livestock farming while in the more arid south only extensive livestock farming is possible without irrigation. To this harsh environment come the additional challenges associated with climate change.

Land ownership also has an important bearing on agricultural activity. Approximately 39% of Namibia’s land area consists of communal tenure farms operated by family units on land to which they have user rights but no title while 43% of the total land area is made up of commercial farms operated by individuals who hold title to the land. The remaining 18% is state land. Two foundational pieces of legislation have been passed since independence – the Agricultural (Commercial) Land Reform Act of 1995 and the Communal Land Reform Act of 2002 – which have both had a major impact on the agriculture sector. The former also places constraints on foreign ownership of commercial farmland. The communal north and the rest of the country are separated by a veterinary cordon fence – or the “Red Line” – which remains a painful reminder of Namibia’s colonial past even though it serves an important function in preventing the spread of animal diseases to areas of the country which focus on exports. A new Land Bill currenctly before Parliament aims to update and consolidate these two pieces of legislation.

Overview of products and land uses

Source: Atlas of Namibia 2022

Private Producers

Namibia’s agriculture sector is based on production from approximately 10,500 privately-owned commercial farms in the central and southern parts of the country plus the output of the rest of Namibia’s 250,000 rural households on communally-owned land, predominantly in the Northern Communal Areas. The commercial farms tend to focus on cattle and rain-fed crop production in the central parts of the country while in the south sheep, including karakul sheep, and irrigated crop production dominate. Commercial farmers pay a land tax based on a valuation roll which is periodically updated. Communal farms tend to focus on rearing sheep and goats plus producing mahangu (pearl millet) in the north. The Namibia Agricultural Union represents commercial farmers as well as its affiliate the Agricultural Employers Federation.

Ministry of Agriculture, Fisheries, Water and Land Reform and Other Public Agencies

The Ministry of Agriculture, Fisheries, Water and Land Reform is the key policy-making institution for the industry headed since 7 May 2025 by the Honourable Minister of Agriculture, Fisheries, Water and Land Reform Inge Zaamwani. Namibia’s last formal agriculture policy was published in 2015. The Ministry oversees a number of public agencies which aim to promote agricultural development. The Agricultural Bank of Namibia (Agribank) provides finance to commercial and communal farmers including for the Affirmative Action Loan Scheme which is designed to help larger communal farmers purchase commercial land and become fully-fledged commercial farmers. The Livestock and Livestock Products Board regulates and promotes the livestock industry while a commercial public enterprise, the Meat Corporation of Namibia (Meatco), processes meat purchased from Namibian livestock producers above and below the Red Line and sells it to markets in Namibia, South Africa, the EU, Norway, China, the US and selected African markets. Meatco also owns the Okapuka tannery outside Windhoek. The Namibian Agronomic Board regulates and promotes the agronomic industry including import controls for controlled grains (maize, wheat and mahangu), regulates grain processors, and implements the National Horticulture Development Initiative which encourages greater domestic production of fruit and vegetables primarily for domestic consumption. The Agro-Marketing and Trade Agency aims to promote food security, facilitate trade and storage, promote value addition, and promote local consumption. The Agricultural Trade Forum is a membership organisation which provides a structure for dialogue between Government and the private sector on agricultural trade issues. AGRIBUSDEV was created to run Government’s Green Scheme but is being wound up. The Karakul Board oversees Namibia’s karakul industry. There is the Agricultural Trade Policy Institute in the Namibia University of Science and Technology.

Livestock, Game, Poultry, Dairy and Karakul

Namibia’s commercial livestock farmers raise mainly cattle and sheep but many have diversified into game such as kudu or oryx and also ostrich while some pig farming has also taken place. Livestock producers sell to local abattoirs as well as on the hoof to South Africa and (occasionally) other countries. There are some 43 licenced abattoirs in Namibia but by far the largest are the five export abattoirs: Meatco’s in Windhoek and Okahandja, Beefcor’s in Okahandha, Ohlthaver & List and Hartlief’s Farmers Meat Market for lamb in Mariental, and Zambezi Meat Corporation’s abattoir in Katima Mulilo. Namibia has traditionally been a net exporter of livestock and meat which forms the basis of related industries in hides and skins. Namibia enjoys preferential access to the EU, UK, Norwegian and US markets and became the first country in Africa to export beef to China and the US in 2019 and 2020. Namibia Poultry Industries, owned by Namib Mills, operates a breeder, a hatchery, a broiler farm, and a slaughtering facility outside Windhoek processing 250,000 birds a week and selling fresh and frozen chicken products under the RealGood and NAM Chicken brands. Namibia Dairies, owned by the Ohthaver & List Group, operates the !Aimab Superfarm outside Mariental and produces fresh and UHT milk and a range of other dairy products. Karakul is now much more of a niche industry selling karakul pelts under the Swakara brand name at Denmark’s Kopenhagen’s Fur Auction House in March and September every year but which was closed by the Danish government in 2020. Detailed statistics on livestock sales, prices, slaughtering and exports can be obtained from the Meat Board of Namibia’s website. Namibia’s last livestock census was carried out in 2023. Private producers are organised into a number of influential industry groupings including the Namibia National Farmers Union, the Livestock Producers Association, the Namibian Emerging Commercial Farmers Forum, and the Abattoirs Association of Namibia.

Cereal, Crops and Horticulture

Namibia has historically been a net importer of basic staple grains maize and wheat and produces pearl millet or mahangu which are classified as “controlled crops” under the Agronomic Industry Act of 1992. There are several thousand maize producers, most of whom are small communal farmers mainly in the Kavango and Zambezi regions while wheat is produced by a small number of large-scale commercial farmers using irrigation. Namibia’s commercial “maize triangle” lies between Otavi, Grootfontein and Tsumeb. Maize and wheat is sold to licensed private millers including the two major ones, Namib Mills with operations in Windhoek, Otavi and Katima, and Bokomo in Windhoek. As with maize, mahangu is produced by thousands of small-scale producers in the north, some of which is sold by Namib Mills under the Meme Mahangu brand. Namibian producers of controlled grains enjoy a guaranteed local market for all saleable output as millers are obliged to purchase their grain from local producers during the closed-border period operated by the Namibian Agronomic Board. The industry is organised through the Namibian Grain Producers Association.

Historically, Namibia imported the vast majority of its fruit and vegetables from South Africa but the National Horticulture Development Initiative (NHDI) and the Namibian Horticulture Market Share Promotion (NHMSP) which started in 2004 has changed this situation. Importers are obliged to purchase an annually determined share of fruit and vegetables from local producers and this share has increased from 3% in 2004 to almost 50% in recent years. Team Namibia’s “Buy Namibian” initiative has been used as a marketing tool for NHMSP helping to bring local produce to the attention of local consumers. The Initiative is financed by a levy payable to the Namibian Agronomic Board.

Government launched an ambitious Green Scheme in 2008 which was designed to bring large tracts of land into commercial production for crops and horticulture. These eleven operations in various parts of the country were run by a specially created agency AGRIBUSDEV but made sustained losses leading to its dissolution in 2023.

Table Grapes and Charcoal

Finally, since the 1990s Namibia has produced world-class table grapes for export from farms on the north banks of the Orange River on the southern border. Due to specific climatic conditions, grapes from southern Namibia can earn a premium in European markets because of their availability in early November, a month ahead of any southern hemisphere competition. Namibian grapes enjoy preferential access to the EU market and also the US market under African Growth and Opportunity Act. The Namibian Grape Growers Association represents the industry.

Namibia is also increasing the volume of charcoal it produces and exports. This is mainly produced by commercial farmers rearing livestock who harvest invader bush and burn it around their farms which is then transported to centralised packaging plants and exported, mainly to the EU and UK. The industry is organised into the voluntary membership organisation the Charcoal Association of Namibia and Namibian charcoal is certified by the Forestry Stewardship Council.

[this is needed for pages which display statistics and charts but is not displayed unless you are logged in]

DATA - Sectoral Breakdown of GDP

| Sector | gdp | year |

|---|---|---|

| Livestock Farming | 2.5 | 2024 |

| Crop Farming | 2.1 | 2024 |

| Fishing | 2.7 | 2024 |

| Mining | 13.3 | 2024 |

| Manufacturing | 10.6 | 2024 |

| Electricity and Water | 3.6 | 2024 |

| Construction | 1.4 | 2024 |

| Trade | 11.4 | 2024 |

| Hotels | 1.6 | 2024 |

| Transport and Storage | 3.5 | 2024 |

| ICT | 1.1 | 2024 |

| Financial Intermediation | 7.7 | 2024 |

| Real Estate | 4.7 | 2024 |

| Other Services | 3.0 | 2024 |

| Public Administration | 8.6 | 2024 |

| Education | 9.1 | 2024 |

| Health | 3.3 | 2024 |

| Private Households | 0.7 | 2024 |

| Taxes less subsidies | 9.4 | 2024 |